The dust hasn’t even settled on the Netflix-Warner Bros. deal, and Paramount Global has already detonated the next bomb. The company has submitted an official hostile bid for Warner Bros. Discovery—an aggressive move aimed squarely at undercutting Netflix’s path to finalizing its $82.7 billion acquisition. This isn’t shaping up to be a polite boardroom scuffle; it’s a knife-fight that will almost certainly land in front of regulators, the courts, and every antitrust expert within cab distance. And for the thousands of people working inside Warner Bros. Discovery, the fallout is unlikely to be kind.

Cutting to the chase, here’s what Paramount Global is putting on the table:

The Offer

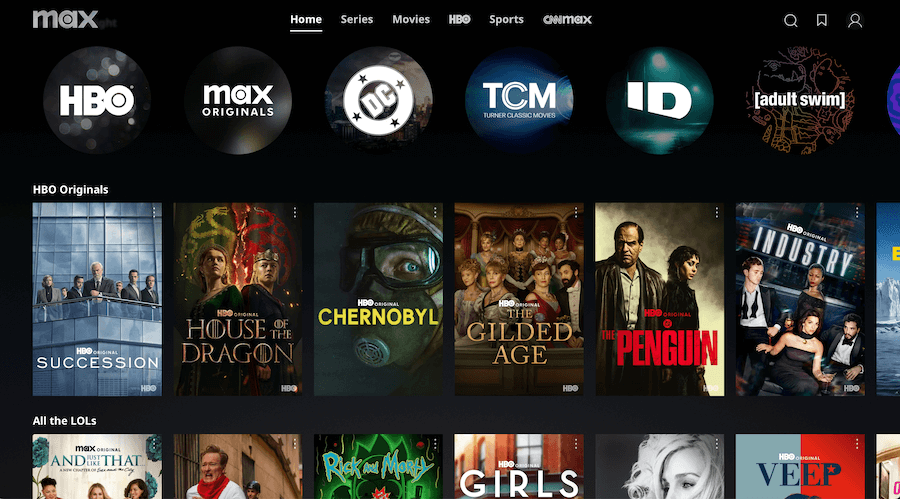

$30 per share in cash for Warner Bros. Discovery, outbidding Netflix’s $27.75 per-share cash-and-stock proposal. And unlike Netflix, Paramount isn’t cherry-picking—it wants the entire Warner Bros. Discovery portfolio, including Warner Bros. Studios, HBO/HBO Max, CNN, TNT, and every other asset under the WBD umbrella.

Acquisition Enterprise Value

Roughly $108 billion, a massive leap over Netflix’s $82.7 billion offer and a clear signal that Paramount is willing to burn fuel to win this fight. Netflix, of course, is more than capable of raising its bid, while Paramount’s offer is being propped up by external financial backers—including some outside the U.S., which is almost guaranteed to raise eyebrows in Washington.

This battle isn’t just heating up—it’s heading for a full-blown death match beneath Hawkins… sorry, Hollywood.

The Strategy

Paramount’s move is engineered to go around the Warner Bros. Discovery board, which has already signed off on the Netflix deal, and pitch directly to WBD shareholders. The goal is simple: convince enough shareholders to reject the board-approved Netflix offer and instead back Paramount and its incoming owner, David Ellison. If Paramount secures 50% plus one share of WBD, it gains the leverage to dissolve the current board, replace it with one aligned to Ellison’s bid, and push the hostile takeover through.

The Offer Motive

Publicly, David Ellison—Paramount’s principal owner—frames the bid as a strategic play to merge Paramount+ and HBO Max into a single heavyweight streamer capable of standing toe-to-toe with Netflix and Disney+. But even with that merger, the math is unforgiving: a combined Paramount+ and Max platform would sit at roughly 209 million subscribers, edging past Disney+ but still trailing Netflix by about 100 million. By contrast, a Netflix-Max union would command more than 440 million global subscribers, a figure so large it would effectively warp the competitive landscape.

Here’s how the current global subscriber counts stack up:

- Netflix: 301 million

- Amazon Prime Video: 200 million

- Disney+: 131–153 million

- Max (HBO/Discovery+): 130 million

- Tencent Video (China): 114 million

- iQIYI (China): 101 million

- JioCinema (India): 100 million

- Paramount+: 79 million

- Hulu: ~55–64 million

- Peacock: 41 million

But subscriber math is only one layer of the motive. Both Warner Bros. and Paramount control legendary film and TV catalogs built over nearly a century. Combining those libraries would create an unprecedented content empire—one with the power to dominate theatrical releases, streaming windows, and TV syndication. Whether that strengthens the movie theater ecosystem or puts exhibitors under the heel of a new Paramount–WB super-studio is an open question; theater owners already struggle with Disney’s aggressive distribution tactics.

A third pillar of the bid is control over WBD’s vast television footprint, including CNN, TNT, TBS, and the rest of the cable portfolio. And if Paramount prevails, one outcome is almost inevitable: CNN would likely be merged with CBS News, because regulators aren’t going to sign off on two competing national newsrooms under the same owner, and the financials don’t support running parallel operations. TNT has already been outmaneuvered by ESPN, TBS isn’t exactly keeping anyone up at night, and whichever buyer wins—Paramount or Netflix—these networks are headed for a painful shake-up.

Paramount will never shutter legacy institutions like CBS News or 60 Minutes, and the possibility of Bari Weiss steering a merged CNN/CBS newsroom is the kind of scenario that will send tremors through CNN’s leadership ranks. In this business, payback tends to arrive with interest.

Chairman and Chief Executive Officer

Paramount, a Skydance Corporation

The Players

The driving force behind Paramount Global’s hostile bid is David Ellison, CEO of Skydance and the incoming owner of Paramount. Backing him are two heavy hitters: his father, Larry Ellison—the enormously wealthy co-founder of Oracle—and Jared Kushner, President Trump’s son-in-law, who has emerged as an unexpected financial and strategic participant in the bid.

There’s considerable speculation that President Trump himself may be involved behind the scenes. The twist, however, is that despite Kushner’s participation and Trump’s public criticism of the Netflix deal, the former president has a complicated history with Paramount and CBS. He sued CBS (a Paramount property) and walked away with a $16 million settlement, and he’s also blasted the network for airing the Marjorie Taylor Greene interview. In other words, even the political players in this drama aren’t aligned—yet another layer of chaos in an already volatile fight.

Update 12/16/2025: Jared Kushner has reportedly dropped out of participating in Paramounts bid for Warner/Discovery.

Update 1/12/2026: Paramount/Skydance has filed a lawsuit against Warner/Discovery over bid rejection – It might not be over yet folks!

The Bottom Line

Netflix’s proposed takeover of Warner Bros. Discovery has already upended the entertainment world, but Paramount’s hostile bid turns a high-stakes merger into a full-blown knife fight. Netflix may look like the frontrunner, yet it still has to navigate regulators, political scrutiny, and now a rival offer backed by deep-pocketed Ellison money and wildcard political operators. Paramount doesn’t have to win outright to make life miserable for Netflix—they just have to drag this into the courts, the FCC, and the DOJ long enough to sow chaos. And yes, in the current political climate, it’s entirely plausible that President Trump could attempt to overrule whatever the regulators decide, adding another unpredictable layer to the mess.

The breakup fees alone show how dangerous this game has become: if Netflix walks away or gets blindsided by regulators or a successful hostile takeover, it owes $5.8 billion. If WBD backs out, they owe $2.8 billion to Netflix. That’s the kind of punishment that leaves scars.

Paramount’s “StrongerHollywood” campaign underscores just how aggressive this play is—public messaging, shareholder courtship, industry shade-throwing, and promises of $6 billion in cost synergies from merging WBD and Paramount. They claim they’ll streamline the back office, tech, and infrastructure while keeping creative teams intact. Whether that’s visionary or delusional depends on your level of optimism… or your proximity to the layoffs.

But the impact stretches far beyond corporate boardrooms. Movie theater operators could find themselves beholden to whichever mega-studio emerges on top, potentially facing tighter control over release windows and terms. The viewing public may wake up to fewer choices, consolidated catalogs, and a handful of platforms deciding what gets made—and what doesn’t. And for artists, a merger of this scale could mean fewer buyers, less leverage, and creative decisions increasingly dictated by shareholder math rather than storytelling.

What’s clear is this: the future of Hollywood is being rewritten in real time, and the loser in this battle—Netflix, Paramount, Warner Bros. Discovery, or the industry ecosystem orbiting them—is going to feel the shockwaves for years.

Related Reading: