CES 2026 wasn’t about gimmicks or concept nonsense; it was a blunt-force reminder that the living room is now the front line. After hands-on time with some of the best-looking TVs we’ve ever seen, it’s clear that Samsung, LG, Hisense, and TCL and are locked in a no-prisoners fight for your wall and your attention. Sony may have skipped the show floor, but the message from everyone else was unmistakable: image quality, scale, color accuracy, brightness, and processing have reached a point where “going out to the movies” needs a better excuse than tradition.

That escalation is colliding head-on with a far bigger war—one over who controls a century of cinema history and where you’ll be watching it. As Netflix and Paramount circle Warner Bros. and HBO, the industry is reshaping itself in real time. Meanwhile, IMAX just posted its best year ever; proof that premium theatrical experiences still matter—while the overall box office barely crawled past 2024 and remains miles behind pre-COVID reality.

This isn’t speculation or sugarcoating the situation—it’s what the data, the hardware, and the money are already telling us. 2026 is shaping up to be a pivotal year, one where the future of movies, theaters, and how we consume media gets decided not by sentiment, but by screens, ownership, and hard economics

TVs & Projectors at CES 2026: Bigger, Brighter, Smarter & Absolutely Gunning for Movie Theaters

CES 2026 made one thing painfully obvious: TV and projector brands are no longer flirting with your local cinema—they’re trying to replace it. Wall-filling RGB Micro LED, nuclear-bright Mini-LED, OLEDs with contrast and black levels that border on unfair—and projectors with enough light output to survive outside your mother’s basement, where you’re still rage-baiting neighbors and complete strangers across the internet.

CES 2026 might not be the place anymore to hear true reference-grade audio or sit through a perfectly dialed-in home theater experience, but that didn’t stop a six-figure crowd from openly drooling. The official rollout of RGB Micro LED was the headline—led by Samsung and its absurdly imposing 130-inch concept—while the next wave of 83-inch-plus OLED and Mini-LED TVs from LG, TCL, and Hisense made it clear this wasn’t aspirational tech anymore. These displays weren’t just big—they were legitimately excellent.

At this point, 83 inches is the new 65, and 100-inch-plus TVs are very much a thing, provided you have three friends, a professional installer, and the common sense not to attempt a basement staircase unless you’re looking to end friendships and drywall careers simultaneously.

Yes—TCL’s new X11L SQD-Mini LED TV Series starting at $6,999 for a 75-inch is undeniably pricey, but one look explains why. You’ll be shocked—not just that TCL has fully caught up to, and in some cases surpassed, its Korean and Japanese rivals—but by how dramatically image quality has leapt forward in just the last five years. The gap didn’t slowly close; it collapsed.

Meanwhile, LG and Samsung’s latest Art TVs raise the stakes in a different way, pairing bigger screens, cleaner processing, and far better anti-glare performance with genuine access to museum-grade art libraries. These aren’t TVs trying to disappear anymore—they’re TVs confident enough to take over the room and justify it.

The final wildcard at CES 2026 wasn’t hanging on a wall—it was firing at it. Ultra-short-throw projectors are clearly not going anywhere, with Hisense, Formovie, AWOL Vision, and others pushing brightness, color, and contrast harder than ever. A 130 to 200-inch image that drops down when you want it and vanishes into the ceiling when you don’t—beats living with a permanent 100-inch slab of glass bolted to your wall.

And since this is CES in Las Vegas, let’s just say the effect is very Casino: one minute it’s there, the next it’s gone, and Joe Pesci is already asking who’s up for steak and eggs. Clean the sand off the shovel. Then put it back in the trunk.

At the same time, lifestyle projectors like the Valerion VisionMaster Max, XGIMI TITAN Noir Max and Hisense XR10 show enormous potential, thanks to better optics, far higher light output, real portability, and image quality that can hold up outside a pitch-black cave. But potential isn’t the same as execution.

Hisense, in particular, did the XR10 no favors at CES 2026. Its demo undersold what the projector is clearly capable of, and that’s a self-inflicted wound. If brands want consumers to take projectors seriously as a living room solution, they need to stop sabotaging their own hardware on the show floor. On the other hand, Valerion stole the show with the only proper dark room home theater at CES, showcasing the VisionMaster Max in all its beauty with a 200-inch screen, sound system, and reclining theater chairs.

The home theater boom wasn’t a COVID fluke—it was a rehearsal. This is what the future of movie watching looks like, whether the demos keep up or not.

And one final casualty from the CES 2026 show floor: 8K TVs. No breakthroughs, no momentum, no audience. The industry didn’t even bother pretending this time. With no content, no demand, and zero reason to exist alongside ever-better 4K and Mini-LED panels, 8K didn’t stall—it flatlined. Consider this the toe tag.

IMAX’s Best Year Ever: Premium Screens, the Future of Movie Theaters, and the Netflix-Paramount Fight for Warner Bros

While Hollywood restructures and the box office treads water, IMAX quietly posted its best year on record; and I’ve seen exactly why from a seat in the theater. Every IMAX screening I attended in 2025 was packed: Jaws for its 50th anniversary, Back to the Future, and new releases that felt like big screen adventures again.

Audiences are making a very deliberate choice—if they’re leaving the house, it’s for something they can’t replicate at home. Massive screens, reference-level sound, exclusive formats, and true event programming have turned IMAX into the premium exception that still earns time and ticket money. That strategy paid off in a very real way in 2025, with IMAX posting $1.28 billion in global box office, the strongest year in the company’s history and well ahead of its $1.1 billion pre-COVID peak in 2019. IMAX had forecast between $1.2 and $1.25 billion, and still managed to exceed expectations—no small feat in a year where overall box office barely edged past 2024 and remained far below historic norms.

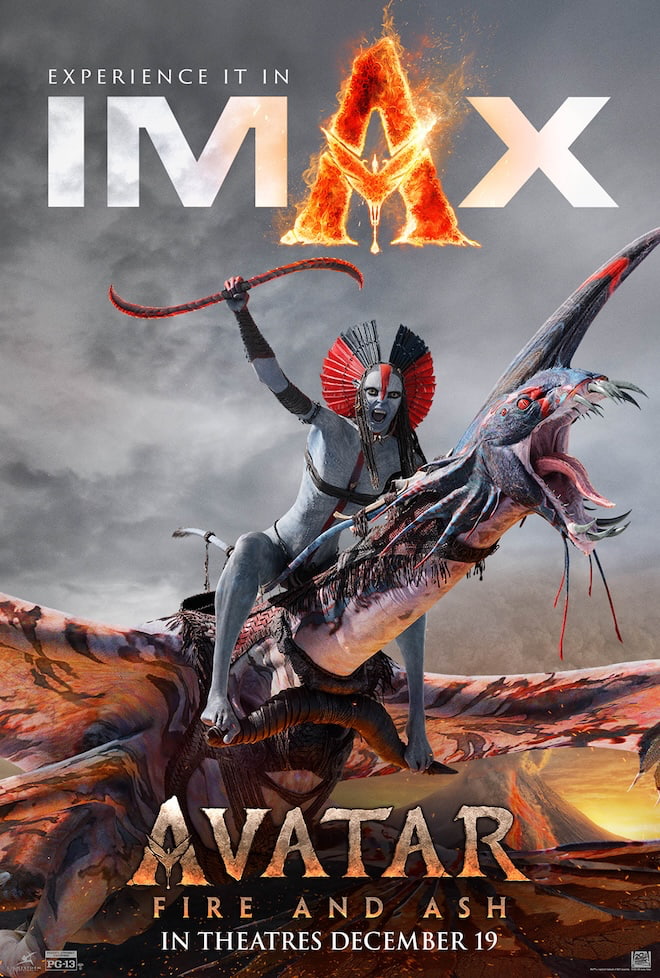

Momentum for IMAX in 2025 came from a mix of global scale and very specific hits that actually performed where the format matters. In China, Ne Zha 2 emerged as a breakout, delivering $166.7 million on IMAX screens and underscoring how central local-language releases have become to the company’s growth. Event films carried equal weight. Avatar: Fire and Ash had already generated $140 million on IMAX screens through January 4, with continued play across the global network extending its run, while F1: The Movie added another $97.6 million in ticket sales. These weren’t marginal gains—they were pillars.

The regional breakdown reinforces how broad that success was. IMAX’s North American box office climbed to $449 million, a 14 percent increase over its previous record set in 2023. Markets outside China contributed $427 million, up 12 percent year over year, while China alone reached $407 million, exceeding the company’s prior peak from 2019 by 5 percent. Just as important, IMAX recorded its strongest local-language performance ever, with $405 million worldwide, representing a 65 percent jump over its 2023 record.

All of that translated into meaningful scale. IMAX finished the year with a 3.8 percent share of the global box office, its highest ever, generated from just over 1,800 screens worldwide. The company released 122 new titles globally, including its most ambitious international slate to date: 67 local-language films from 14 countries.

Looking ahead to 2026, IMAX isn’t talking about recovery—it’s talking about momentum. The company sees continued box office gains driven by a slate built for scale and repeat viewing, including The Odyssey, Narnia, Dune: Part Three, and The Mandalorian and Grogu. At the same time, IMAX is leaning harder into its role as a premium platform for global and event-driven content—concert films, local-language releases, and limited-run spectacles designed to give audiences a reason to leave the house in a market still dealing with post-pandemic and strike-related aftershocks. That strategy underpins IMAX’s forecast of a record $1.4 billion in global box office for 2026, even as the broader exhibition business continues to search for stability.

The bigger picture matters here. As exhibitors brace for a rebound after a soft 2025, IMAX’s performance stands in sharp contrast to the wider box office, which remains well below pre-COVID highs despite modest year-over-year gains. We’ve already broken down the non-IMAX studio box office trends in depth over the past quarter, and those analyses pointed to exactly this outcome: consolidation at the top, fewer true four-quadrant releases, and premium formats outperforming the market. IMAX didn’t defy the data—it followed it earlier and more aggressively than everyone else.

The box office numbers don’t need spin—they already tell a blunt story. Domestic grosses in 2025 landed at roughly $8.9 billion, barely ahead of 2024 and still miles away from the $11-12 billion pre-COVID norm. Release volume hasn’t fully recovered either: 112 wide releases in 2025 versus well over 120 in the peak years. In other words, theaters aren’t collapsing—but they’re running a smaller, leaner business with far less margin for error. This is a market that survives on hits, not depth.

Studio market share makes that imbalance even clearer. Disney dominated 2025 with $6.56 billion in global grosses, dwarfing Warner Bros. at $4.4 billion and Universal at $3.89 billion. Everyone else—Sony and Paramount included—trailed far behind. Domestically, Disney’s near-28% market share underscores the problem: fewer studios are carrying more of the load, and the middle of the release calendar continues to hollow out. Theatrical isn’t dead, but it’s increasingly polarized between mega-events and everything else fighting for oxygen.

That’s why what happens next may matter more than the raw box office totals. As Netflix and Paramount circle Warner Bros. and HBO, the fight isn’t just about streaming scale—it’s about who controls one of the deepest theatrical libraries and pipelines in the industry. If Netflix and Warner Bros. tilts further toward streaming-first economics, theaters lose another major supplier of adult, mid-budget, and prestige titles. If theatrical remains a core pillar, premium formats and event releases stay viable.

It also doesn’t help that the Warner Bros. board rejected Paramount’s latest offer this week, a move that on the surface seems to hand momentum to Netflix. And Netflix isn’t wasting time. The company has already been spotted in Washington, quietly working the halls with regulators and Members of Congress, doing what companies at this scale always do when the stakes are existential. Still, optics don’t equal outcomes. A deal of this magnitude isn’t getting rubber-stamped—it’s looking at 12 to 18 months of regulatory review, assuming it survives at all.

That timeline matters. If this thing clears, it would land right as Netflix Studios Fort Monmouth, now slated to become the largest film studio east of Hollywood—opens in late 2027, roughly two miles from my front door. That’s not coincidence; that’s strategy playing the long game. And don’t expect this to stay confined to boardrooms and regulators. Litigation from theater owners—both domestic and international—is almost guaranteed, because for exhibitors, this isn’t about market share or branding. It’s about access, survival, and whether theatrical remains part of the business model—or gets quietly rewritten out of it.

One late-2025 curveball complicates that picture. Netflix did, in fact, toss theaters a bone by putting the “Stranger Things” finale on 4,000+ screens nationwide. It wasn’t a traditional ticketed run—many theaters charged for a concession bundle instead—but it still translated into tens of millions of dollars for exhibitors and packed houses full of people who suddenly remembered where the popcorn lives. Call it nostalgia, call it marketing theater, call it a limited détente—but it wasn’t nothing.

Does that mean Netflix is warming up to theatrical? Not necessarily. But anyone who thinks Netflix will casually walk away from potentially billions in first-run box office by ignoring 4,000+ premium screens for its biggest films is, bluntly, not great at math. The bigger concern sits elsewhere for enthusiasts: if Netflix gains total control over Warner Bros., does it pull back on its physical releases? That’s what worries a lot of us who still buy movies—because we’re talking hundreds of thousands of copies versus millions, and those numbers don’t scare streaming executives anymore.

Related Reading:

- Netflix Moves To Acquire Warner Bros. And HBO In A Deal That Could Rewrite Hollywood’s Future

- Netflix Q1 2025 Earnings Soar: AI Search, New Jersey Studio & No Tariff Tantrums

- The Biggest Consumer Audio & Video Stories of 2025: What Mattered, What Changed, and Why Content Still Rules

- Paramount Launches Hostile Bid For Warner Bros. Discovery As High-Stakes Showdown With Netflix Erupts

- All Coverage From CES 2026

Antonio

January 10, 2026 at 1:17 pm

Loved this and thank you for taking the time to include all of the relevant financials.

I never would have imagined IMAX being that successful in the current environment, but guess I was wrong.

I think 3-4 studios controlling 95% of what we watch to be a bad thing but money talks.

What did you guys think about the TCL TVs? Very expensive.

Great CES coverage. Better than any of your competitors.

Ian White

January 10, 2026 at 2:55 pm

Anton,

I think the biggest takeaway is that Hollywood has forgotten how to make good movies that actually pull audiences into theaters. When Stranger Things can completely sell-out in movie theaters for a finale episode in both Canada and the United States and other films are basically empty — speaks volumes.

I saw 5 films in IMAX theaters this year and every single one was sold out. I prefer the Dolby Vision experience, but it was a lot of fun to watch Jaws that way and the audience was a mix of people like me who saw the movie as a kid and my own children.

IMAX has proven that if you offer a premium experience — people will pay more.

I’m on Team Netflix for personal reasons (house value, writing opportunities), but I would agree that if they win the WB/HBO fight – the theatrical run of wide release films is going to shorten (unless Marvel figures out how to make good movies again) and you will have to wait less than 3 weeks to see tentpole films at home.

According to Brian, Chris, and Robert — TCL has a major winner on its hands. The prices right now are very high at launch, but I’d wait 4-5 months (also to see if it does well in the field from a reliability perspective) and I bet you can buy one for a lot less.

All of the brands have really good TVs right now, but the bigger issue is that consumers are very confused by the different types of technology. Like what makes OLED better than MiniLED and is RGB MicroLED worth the expenditure or should you wait another generation?

IW

Asa

January 10, 2026 at 5:36 pm

Thanks for the excellent CES coverage. I follow this plus the NAMM show coming up.

It seems we’re on the verge of the death of physical theater similar to what happened with ‘Drive-ins’ in the late 70s, IMAX and Sphere being the exceptions.

Why sit in sticky seats with high-priced treats, when you can do it from home with room to roam?

Ha…we watched Jaws a few weeks ago as well. Wife had never seen it and she quite enjoyed it. Up next…Duel!

Ian White

January 10, 2026 at 7:39 pm

Asa,

Appreciate the kind words. The 4 of us put a lot of work into the coverage and there is more to come. TV prices have to come down on the larger models, but even my movie theater obsession is starting to wane. I don’t like going anymore minus the IMAX viewings. My local AMC plays the worst films in the Dolby Cinema theater and I’m not paying that kind of money to watch “The Minecraft Movie” so I can fall asleep.

I was unable to do the Stranger Things thing on NYE because I was discharged from the hospital in the morning. We had 4 seats booked weeks in advance. Gave them away. Watched it at home on the 1st at 8 am. I was high as a kite still. Definitely made me cry less.

The IMAX Jaws experience was amazing. Duel!!! That’s too obscure for my family but I’d watch it alone at like 3 am. I just received my 4K copies of “Sinners,” “F1,” and “Black Bag” so I’ll be doing that on Sunday if the Bills lose.

IW