When Walmart acquired TV brand Vizio for $2.3 billion last year, many industry observers were left puzzled. Why would the world’s largest retailer, already partnered with major TV manufacturers, want to own a brand of its own? After all, profit margins in the television business—especially in the “value” segment dominated by brands like Vizio and Walmart’s own Onn—are notoriously razor-thin.

Given current pricing and the impact of ongoing tariffs, it’s likely that many televisions are now being sold at or even below cost. When new cell phones sell for over $1,000, tell me how a company can sell a 55-inch TV for $228 and make a profit? And that’s not even considering the deals on Black Friday, Prime Big Deals Days, etc.

Of course, TVs are subsidized by things like the “Netflix” button on your TV remote (yeah, Netflix pays companies like Sony and Samsung and LG to include that button), and by the ad income from “FAST” (Free Ad-Supported Television) services like LG Channels and Pluto TV. But this revenue is not enough to explain the bargain basement pricing present on entry-level TVs. But what if it isn’t about the profit? At least not on the hardware side.

Why Are TVs So Cheap? Because You’re the Product

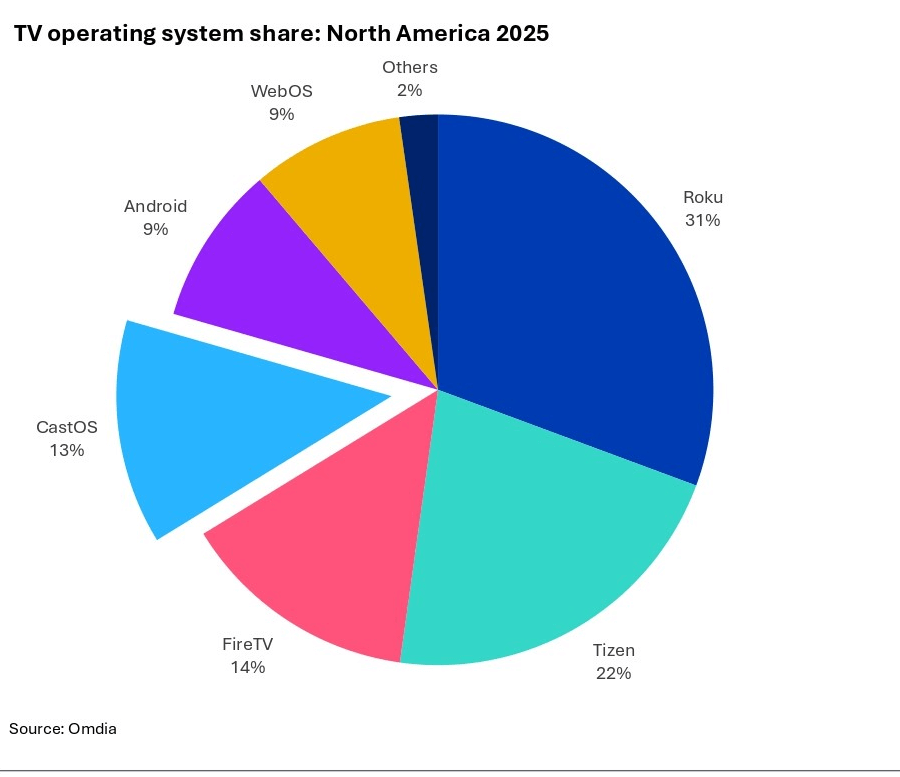

As our Senior News Editor Robert Silva pointed out when covering the Walmart acquisition, Vizio’s “SmartCast” smart TV platform had roughly 8% market share of the streaming Operating System market in the United States. This meant Vizio could target millions of U.S. consumers with tailored ads, based on their specific viewing habits. Walmart saw this as an opportunity to allow them both to advertise to their own customers and prospective customers, but also to lease this space to other advertisers in search of this kind of specialized targeting. Finding out more about you, the TV owner, allows the company to generate recurring advertising revenue – and direct sales – for years over the life of the TV.

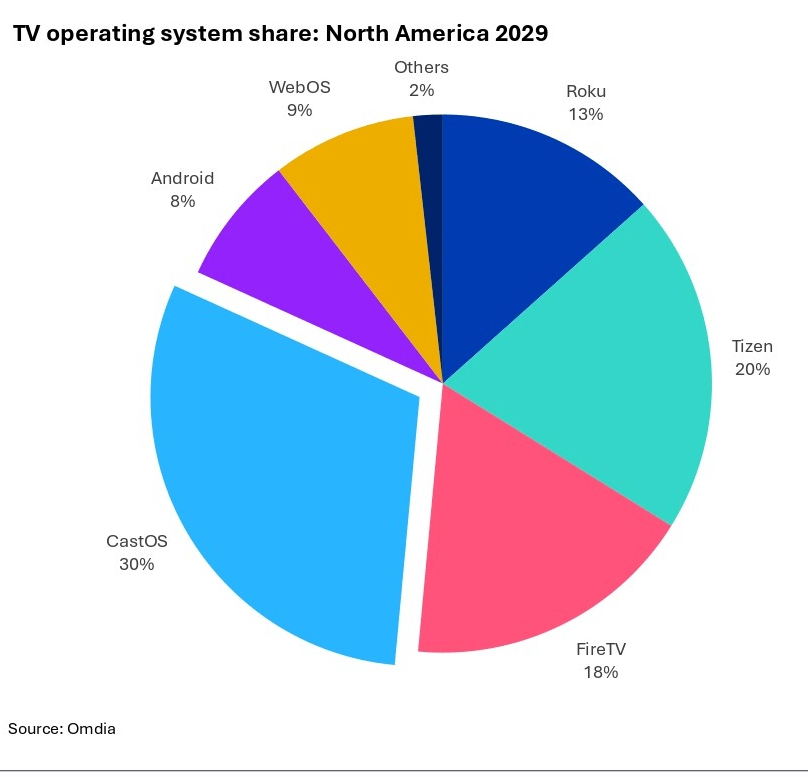

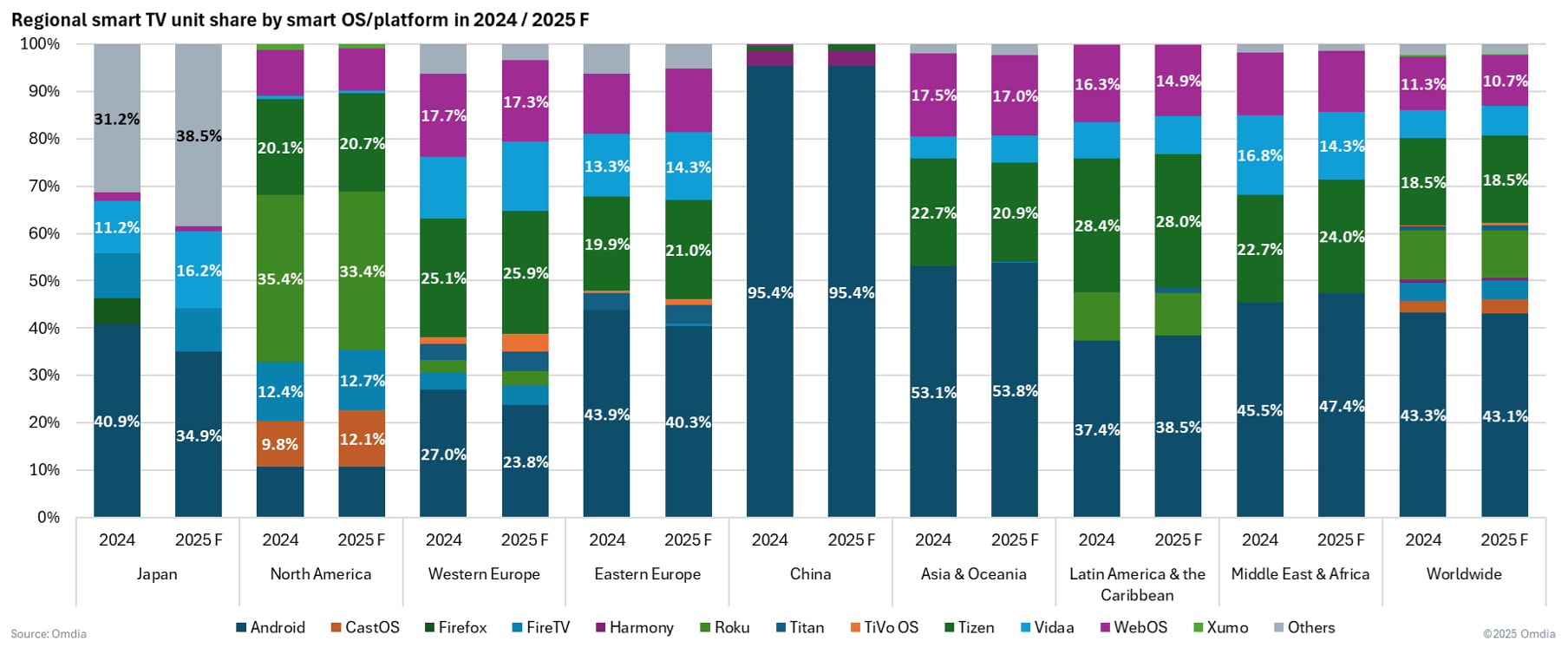

It looks like Walmart’s investment may be paying off. Research firm OMDIA recently shared the results of a new study focusing on the North American TV operating system market. Based on the study, OMDIA is forecasting that Walmart’s proprietary operating system, CastOS (which is based on Vizio’s SmartCast OS), will become the largest TV operating system by shipments in North America in just four years.

So Long, Roku, and Thanks for All The Fish

Omdia’s Principal Analyst for TV Set Research, Matthew Rubin, projects that CastOS shipments in North America will grow from 6.5 million units in 2025 to 15 million or more in 2029. Rubin says this explosive growth is due not only to the company’s acquisition of Vizio, but also to the more recent decision to roll out CastOS across Walmart’s popular Onn brand of TVs and streaming devices. This means the gradual reduction of Roku-based TVs, which was the company’s previous streaming platform of choice. Rubin says this decision will allow the CastOS platform to “leapfrog ahead of Roku, Tizen (Samsung), and FireTV (Amazon).”

“Walmart’s decision to consolidate its TV platforms will give it a major asset that it can use not only to generate advertising revenue and sales growth, but also to compete more effectively with Amazon, which recently announced a collaboration with Roku to enable advertisers to launch campaigns across the combined installed base, via Amazon,” said Rubin. “Roku needs these kinds of partnerships, as it will inevitably lose shipment volume when it’s replaced as the pre-installed OS for Onn. TVs. However, this shift could prompt a reset in its international growth strategy.”

Following in Amazon’s Footsteps

Amazon has been one of the top retailers to capitalize on this monetization of personal data. The company’s Prime Video service embeds links in their ads to “send to your phone.” See something you like? Click your TV remote and suddenly, BOOM, the item is in your Amazon cart. That’s powerful. This is why we’re seeing so many low-priced Fire TV Sticks and Fire TVs. It’s the Trojan Horse that enters your home like a fine prize, but instead of an army of hostile soldiers emerging, the TV or streaming stick just asks you to share a few personal details in exchange for “free content.” And now your viewing and listening habits are being collected to target just the right offer to you at just the right time.

Give Away the Razor, Charge for the Blades

Indulge me a small aside… When Gillette invented the safety razor in the early 20th century, they could charge whatever they wanted for the handle and the blade, because they owned the patent. But once this patent expired and competitors began to flood the market with cheap knockoffs, Gillette had to change its strategy. By virtually “giving away” the razor handle at a very low price, the company opened up a lucrative lifetime market of repeat purchases of the blades to go with that handle. Keurig adopted that same strategy: offer a relatively inexpensive coffee maker, but sell expensive proprietary cartridges to make the actual coffee.

The TV market is now following this same model. The hardware itself is almost irrelevant. It’s the data collected by that hardware that has real value. And if you own the platform that collects those data, you ensure a recurring stream of income for years to come. Use it yourself to capitalize on impulse purchases or sell the data to advertisers who want their product or service in front of a very specific audience, at just the right time.

The Global Perspective

While Walmart’s CastOS is expected to make large gains in market share in North America, this may only amount to a blip in the global TV OS market. Walmart’s operations are heavily focused on North America with nearly 50% of its retail presence in the United States alone. While they have a growing footprint in parts of Asia and South America, they are virtually invisible in Europe and many other world markets.

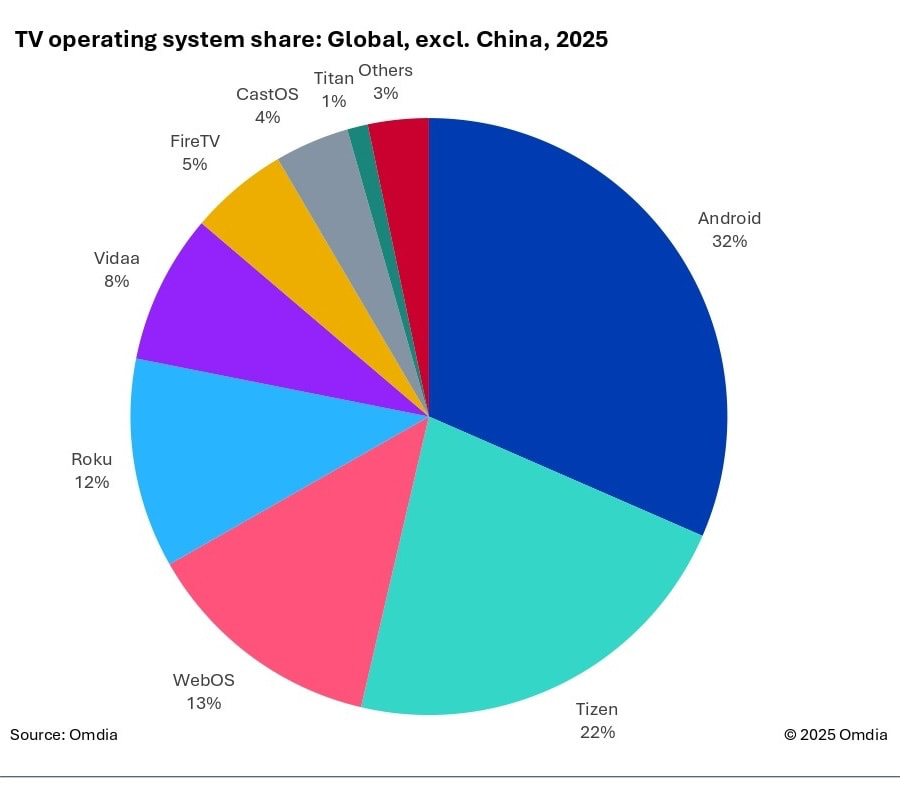

Globally, Android is expected to remain the leading platform throughout the forecast period, decreasing from 42% of shipments in 2025 to 39% (projected) in 2029. Samsung’s Tizen is set to remain the second-largest TV operating system, though it is also expected to decline globally from 17% market share in 2025 to 16% in 2029.

Beyond CastOS, Omdia predicts that the fastest-growing TV operating systems globally will be Vidaa (Hisense), increasing from 6% in 2025 to nearly 8% in 2029, and Amazon’s Fire TV, increasing from 4% in 2025 to just over 5% in 2029.

According to Rubin, “European-based retailers and platform providers are watching developments in North America closely, as a similar, retailer led, consolidation strategy could emerge in the region in the coming years.”

Full details are available in the report linked below (ironically available for free as long as you provide some light personal information).

TV Design Features Tracker and Forecast – Q2, 2025 (Omdia)

The Bottom Line

This research from Omdia shows the value of personal consumer data in today’s TV viewing marketplace. Walmart appears to be poised to capitalize on this opportunity by spreading its tendrils out to a larger and larger consumer base. We have to wonder how Roku will fare as one of its largest retail partners pulls back from their partnership and moves forward with its own smart TV/streaming platform. Hopefully for Roku, they’ve got other options.

Of course, many factors could impact the growth of Walmart’s CastOS. Adoption of the platform doesn’t depend solely on the price of the “Trojan horse” that brings it into your home. Ultimately CastOS has to be a robust and easy-to-use platform in order for people to want to use it. Will Walmart be successful enough to displace the established leaders of the space in such a short time? We shall see. In the mean time, before you snag that great TV deal on Black Friday, take a pause – is this a company you trust with your personal information?

Related Reading:

- Samsung Launches Perplexity AI-Powered TV App, Bringing Generative AI Assistance To Smart TVs

- Roku Unveils New TVs And Slimmest Streaming Sticks Ever

- Walmart Buys Vizio For $2.3 Billion [Updated]

- Roku 2025 TV Refresh: What To Expect From Select, Plus, And Pro Series